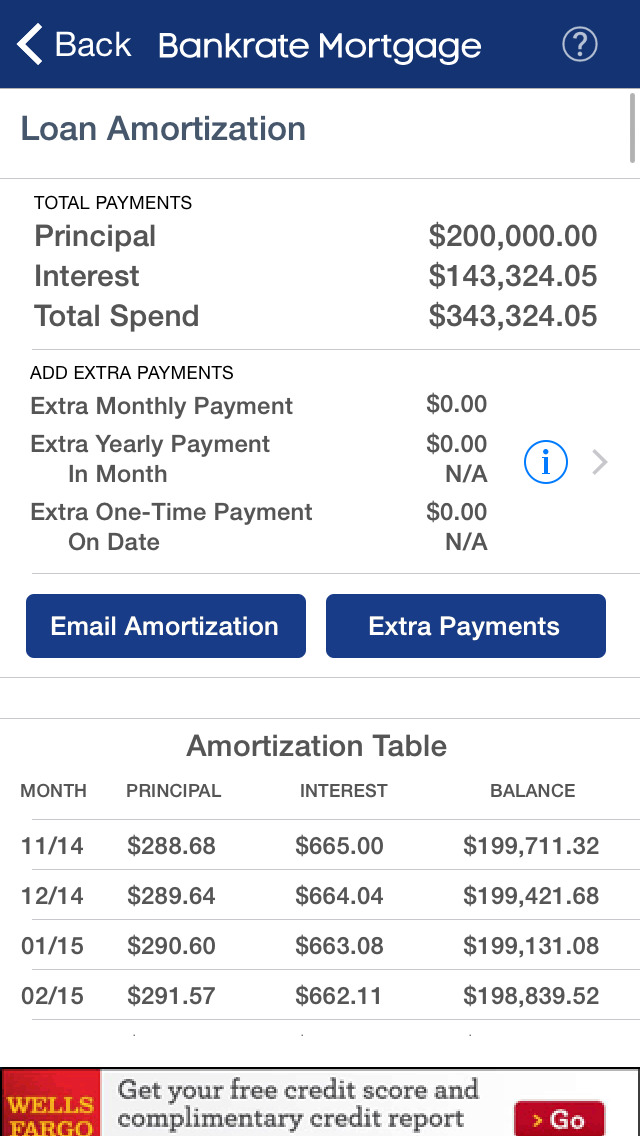

If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment. Property taxes: Local authorities assess an annual tax on your property.Interest rates are expressed as an annual percentage. Interest: This is what the lender charges you to lend you the money.Principal: This is the amount you borrowed from the lender.You can edit these amounts or even ignore them as you're shopping for a loan - those costs might be rolled into your escrow payment, but they don't affect your principal and interest as you explore your options. Bankrate's calculator also estimates property taxes, homeowners insurance and homeowners association fees. Your rate will vary depending on whether you’re buying or refinancing.Īs you enter these figures, a new amount for principal and interest will appear to the right.

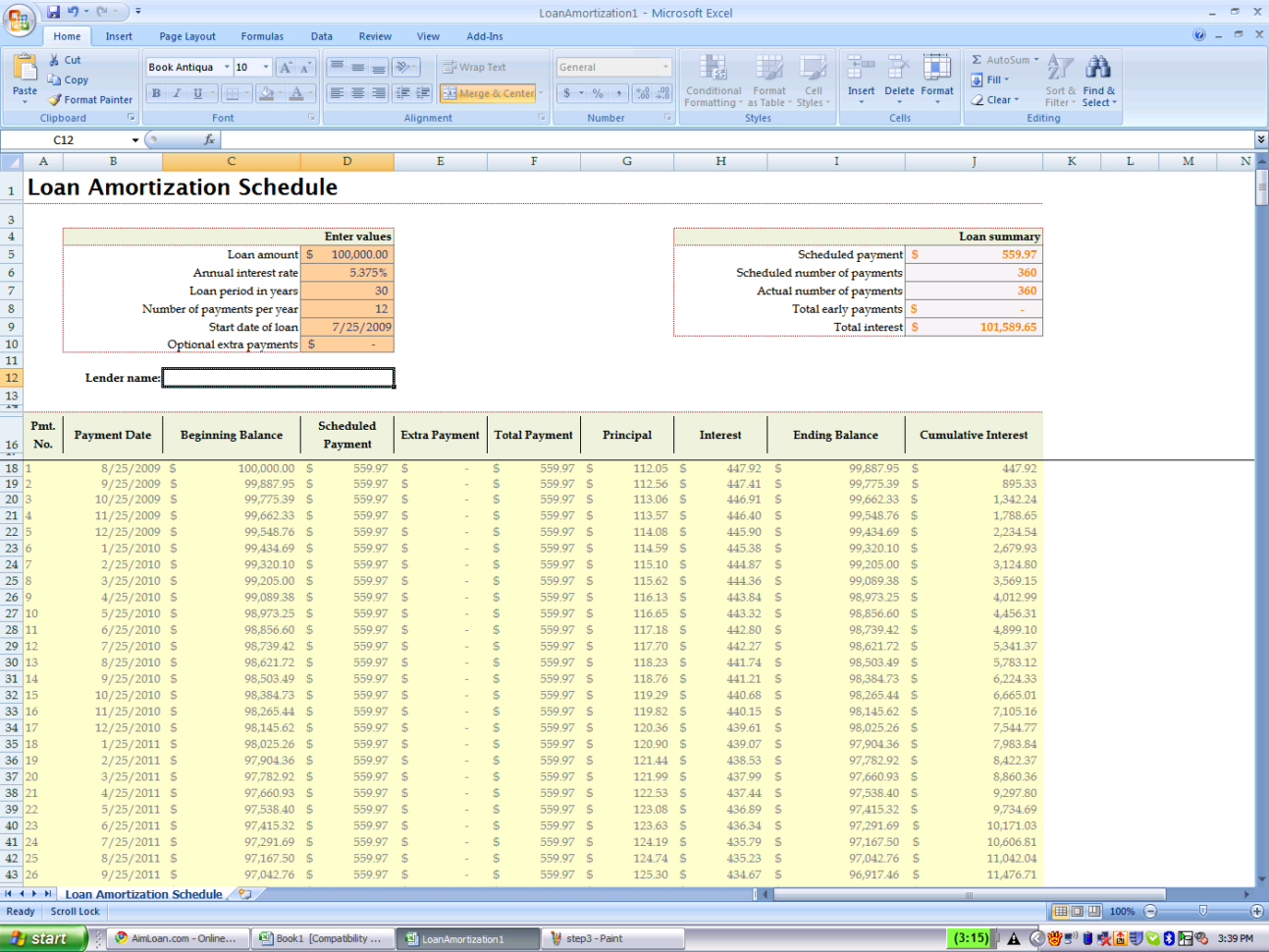

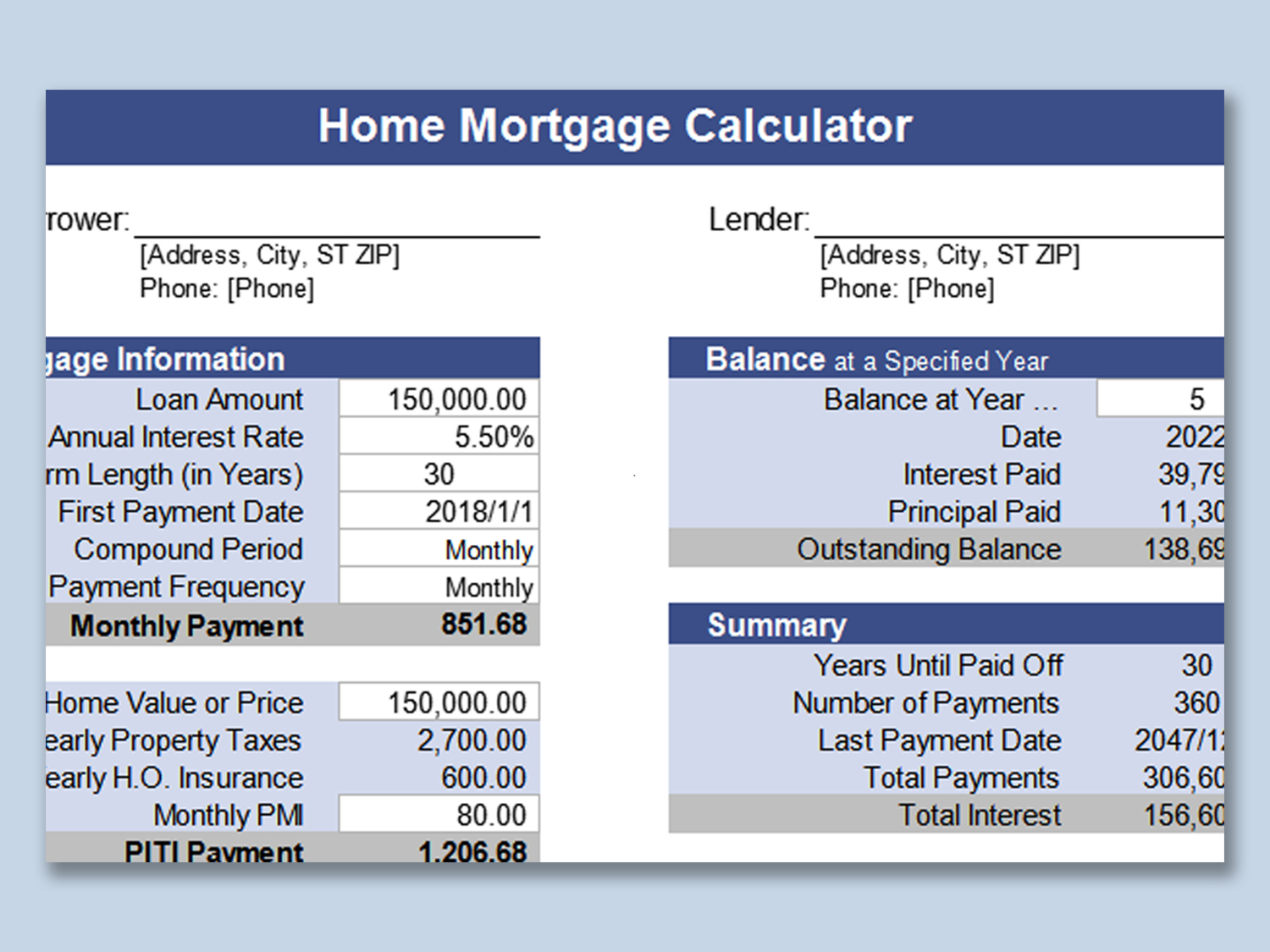

Our calculator defaults to the current average rate, but you can adjust the percentage. Next, you'll see “Length of loan.” Choose the term - usually 30 years, but maybe 20, 15 or 10 - and our calculator adjusts the repayment schedule.įinally, in the "Interest rate" box, enter the rate you expect to pay. You can enter either a dollar amount or the percentage of the purchase price you're putting down. A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe. In the "Down payment" section, type in the amount of your down payment (if you're buying) or the amount of equity you have (if you're refinancing). and a recalculation of the amortization schedule, based on a new term.įurther, "an amortization schedule is a table detailing each periodic payment on an amortizing loan (typically a mortgage), as generated by an amortization calculator." (To be technical here, I take issue with the use of the word "regular" as used in the definition.The calculus behind mortgage payments is complicated, but Bankrate's Mortgage Calculator makes this math problem quick and easy.įirst, next to the space labeled "Home price," enter the price (if you're buying) or the current value of your home (if you're refinancing). Since it is not fully amortized, a balloon payment is required at the end of the. hot air balloons hit the skies at the Erie Town Fair.Ī balloon loan is a type of loan that does not fully amortize over its term. Census Bureau data, we weighed median home values and monthly homeownership costs, including mortgage payments, real estate taxes. The monthly payments for the time period prior to the balloon’s due date are generally calculated according to a 30 year amortization schedule. To use for a balloon schedule, enter all 4 values (loan amount, number of payments, interest rate and normal payment amount) and calculator will show final balloon payment.Ī balloon mortgage requires monthly payments for a period of 5 or 7 years, followed by the remainder of the balance (the balloon payment). However, this amortization schedule will create a balloon payment schedule and you can set both the loan date and first payment date. print capability and downloadable into Microsoft Excel. piti is an acronym that stands for principal, interest, taxes and insurance.Ģ36 Interest reduction Payments must also be tracked as part of the amortization schedule if the loan has IRP subsidies.

BANKRATE MORTGAGE CALCULATOR WITH TAXES AND INSURANCE FREE

define balloon payment bankrate free mortgage Calculator Mortgage calculator with taxes and insurance Use this PITI calculator to calculate your estimated mortgage payment. While there are no legal definitions in the United States for predatory lending per se, a 2006 audit report from the office of inspector general of the Federal deposit insurance corporation (fdic) broadly defines predatory lending as. Note Maturity Calculator balloon mortgage definition Predatory lending refers to unethical practices conducted by lending organizations during a loan origination process that are unfair, deceptive, or fraudulent. This can be very tricky also as you will start to accrue more interest payments as the length of your mortgage was extended.

0 kommentar(er)

0 kommentar(er)